Options traders rely on a variety of tools and indicators to develop their trading strategies. Among these tools, the option chain is particularly popular in the trading community. By using an option chain, traders can not only plan their trades but also gain valuable insights into market trends.

In this post, we will delve into the intricacies of the option chain and how to create a strategy using the same. Traders can also use an option strategy builder to elevate their option trading experience.

Table of Contents

What is an Option Chain?

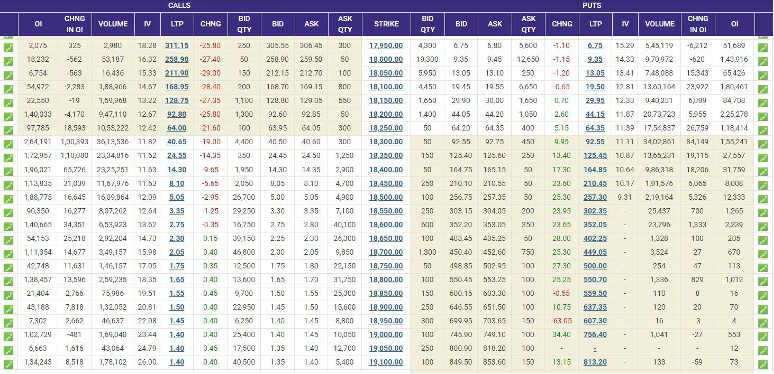

An option chain is a table that lists all available options for a particular security, including their strike prices, expiration dates, premium prices, volume, change in implied volatility, and change in open interest for each option. Adani Enterprises option chain, ITC option chain, and ICICI bank option chain are some examples of stock-based option chains.

An option chain is an essential tool for traders to identify patterns and trends and make informed trading decisions. For instance, they may analyze the volume and open interest to determine the popularity of certain options among market participants. They may also use the implied volatility data to gauge the level of risk associated with particular options.

Key Elements of an Option Chain

Here is the list of the most crucial elements of the option chain, which traders need to understand to form their trading strategies:

1. Option Types

There are mainly two types of options: Call and Put. The call option gives the buyer the right but not the obligation to purchase an underlying asset. Likewise, the put option gives the seller the right but not the obligation to sell an underlying asset.

2. Exercise Price & Spot Price

The exercise price is the price at which the option buyer and seller enter into a contract. It is selected from the available strike prices from the option chain. The spot price is equal to the current price or the market price of an underlying asset.

3. Moneyness of Options

Options’ moneyness is referred to as the relationship between the spot price and strike price.

- At The Money (ATM): When the spot price is equal to the strike price.

- In The Money (ITM): When the spot price is greater than the exercise price for call options (vice-versa for put).

- Out of The Money (OTM): When the strike price is greater than the spot price for call options (vice-versa for put).

4. Implied Volatility (IV)

IV is the expected future volatility for an underlying asset in the market. If the implied volatility is higher, option prices will be higher.

How to Create a Strategy Using Option Chain?

Now that the basics are clear, it is time to understand how to create a strategy using an option chain.

To create a successful trading strategy using an option chain, traders need to understand the various elements of the option chain.

In the case of the above Nifty option chain, traders need to assess the current spot price of the underlying asset, and then select an in-the-money (ITM) or out-of-the-money (OTM) option based on their market outlook.

For instance, if the current spot price is around 18240, a trader can select a call option below 18240 or a put option above 18240.

Next, traders need to choose an appropriate trading strategy based on their outlook. For a bullish outlook, they may consider strategies such as a bull call spread or a bull put spread. For a bearish outlook, they may opt for strategies such as a protective put, a bear call spread, or a bear put spread. Alternatively, they may choose neutral strategies such as a covered call.

If a trader finds it challenging to create a strategy based on the option chain analysis, he can use Dhan’s option strategy builder to execute trades efficiently. With this tool, traders can analyze and build customer strategy for any underlying index and even sector-specific stocks such as the Hindalco option chain, TATA Steel option chain, etc.

Conclusion

An option chain provides traders with valuable insights into the option market and helps them identify potential opportunities that align with their trading strategy. However, traders should exercise caution and conduct their due diligence before making any trading decisions.